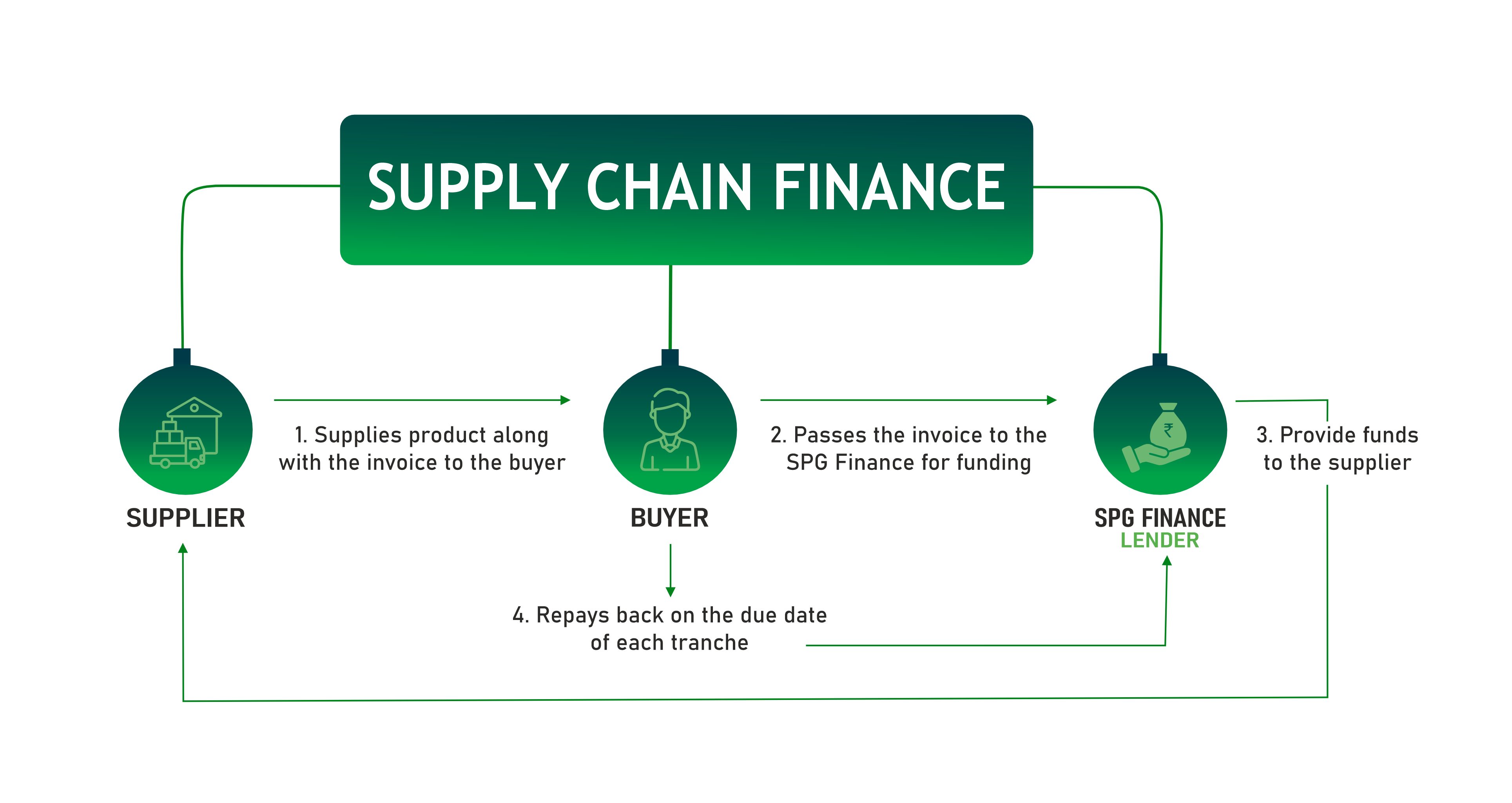

What is Supply Chain Financing?

Supply chain finance is an Anchor-backed financing solution that helps bridge the working capital gap between anchors and their dealers or suppliers. In this arrangement, anchors partner with lenders to offer financing options for their suppliers and dealers. Supply chain facility can be availed for purchases or sales involving corporations or anchors. This solution optimizes cash flow within the supply chain by enabling suppliers to receive early payments on invoices while allowing buyers to extend their payment terms, thus helping to reduce disruptions in the supply chain.

Benefits of Supply Chain Finance

- Healthy cash flow and business growth: This ensure a healthy cash flow since it converts your invoices into cash, which you can invest in your business to achieve the desired growth.

- Higher business flexibility:Supply Chain finance provides higher business flexibility as the cash flow becomes steady and there is no dependence on customers for working capital needs.

- Strengthen Buyer-Supplier relationship: Supply Chain Finance (SCF) strengthens buyer-supplier relationships by improving suppliers’ cash flow and ensuring timely payments, which in turn fosters trust and loyalty. It promotes long-term collaboration, reduces payment conflicts, and enhances flexibility, creating a more supportive and mutually beneficial partnership.

Product Offerings

Dealer Finance

Vendor Finance

Purchase Invoice Discounting

Sales Invoice Discounting

Dealer Finance:

Dealer Financing is a financing arrangement, where the Lender pays the Corporate (Anchor) on behalf of their Dealers (Buyers) for the goods they have purchased.

How does it work?

- The Dealer purchases goods from the Anchor/Corporate.

- The dealer’s working capital gap stop them to pay the full amount upfront.

- SPG Finance pay the anchor upfront under dealer finance arrangement.

- SPG Finance pays the anchor/corporate company on behalf of the dealer.

- The dealer repays the SPG Finance on the due date.

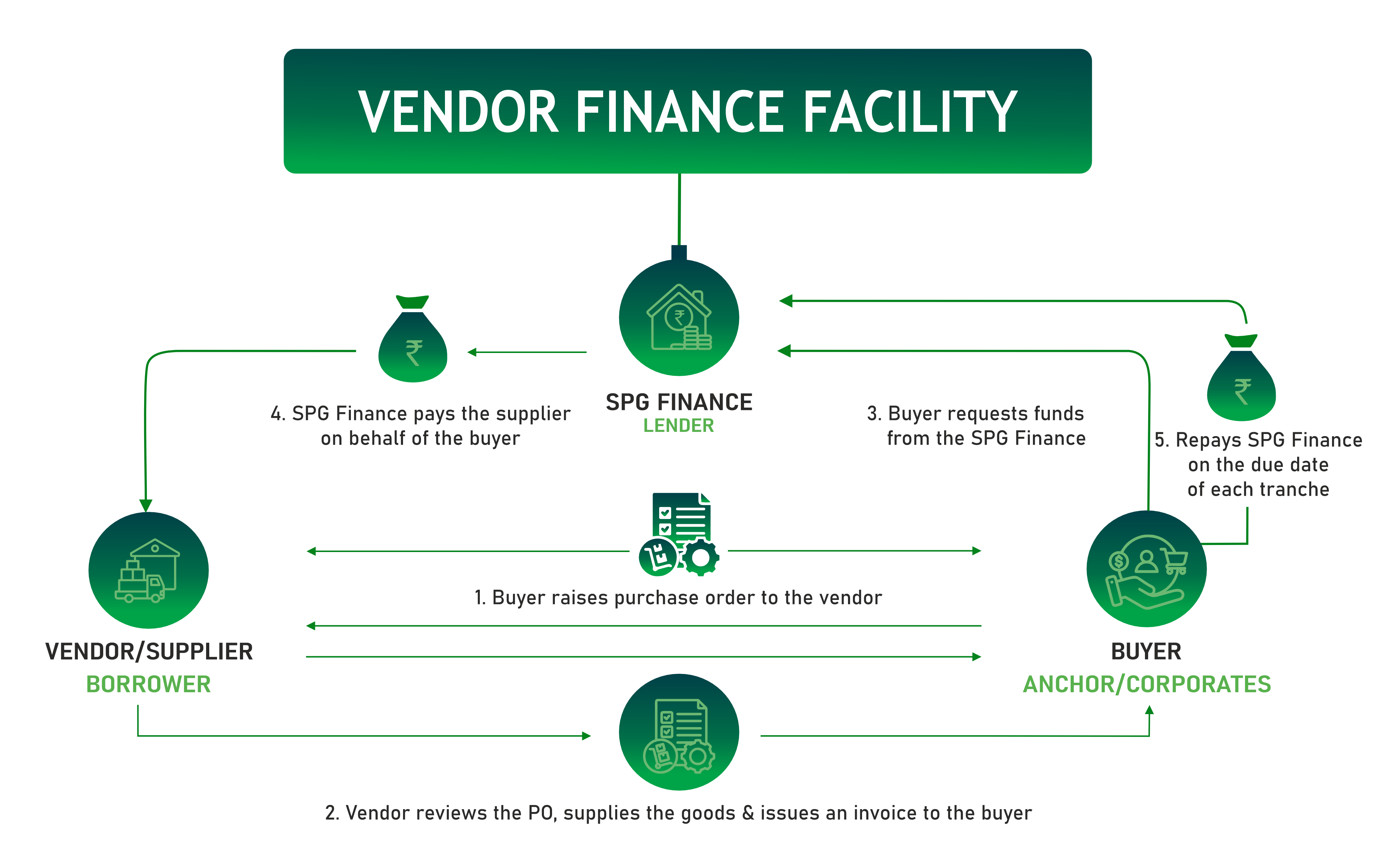

Vendor Finance:

In this arrangement, SPG Finance partners with the Anchor/corporate to offer upfront discounting of purchase invoices of identified vendors by the Anchor/Corporates. This structure enables vendors to receive immediate payment for their supplies and also the anchor/corporates to meet the working capital gap.

Consequently, on the agreed due date, the Anchor repays the discounted amount to the SPG Finance.

How does it work?

- The Supplier sells the goods to the Anchor/Corporate.

- The Anchor/Corporate approaches the SPG Finance to pay the entire invoice amount upfront to the supplier.

- SPG Finance pays the invoice amount to the Supplier.

- Anchor/Corporate repays the SPG Finance on the agreed due date.

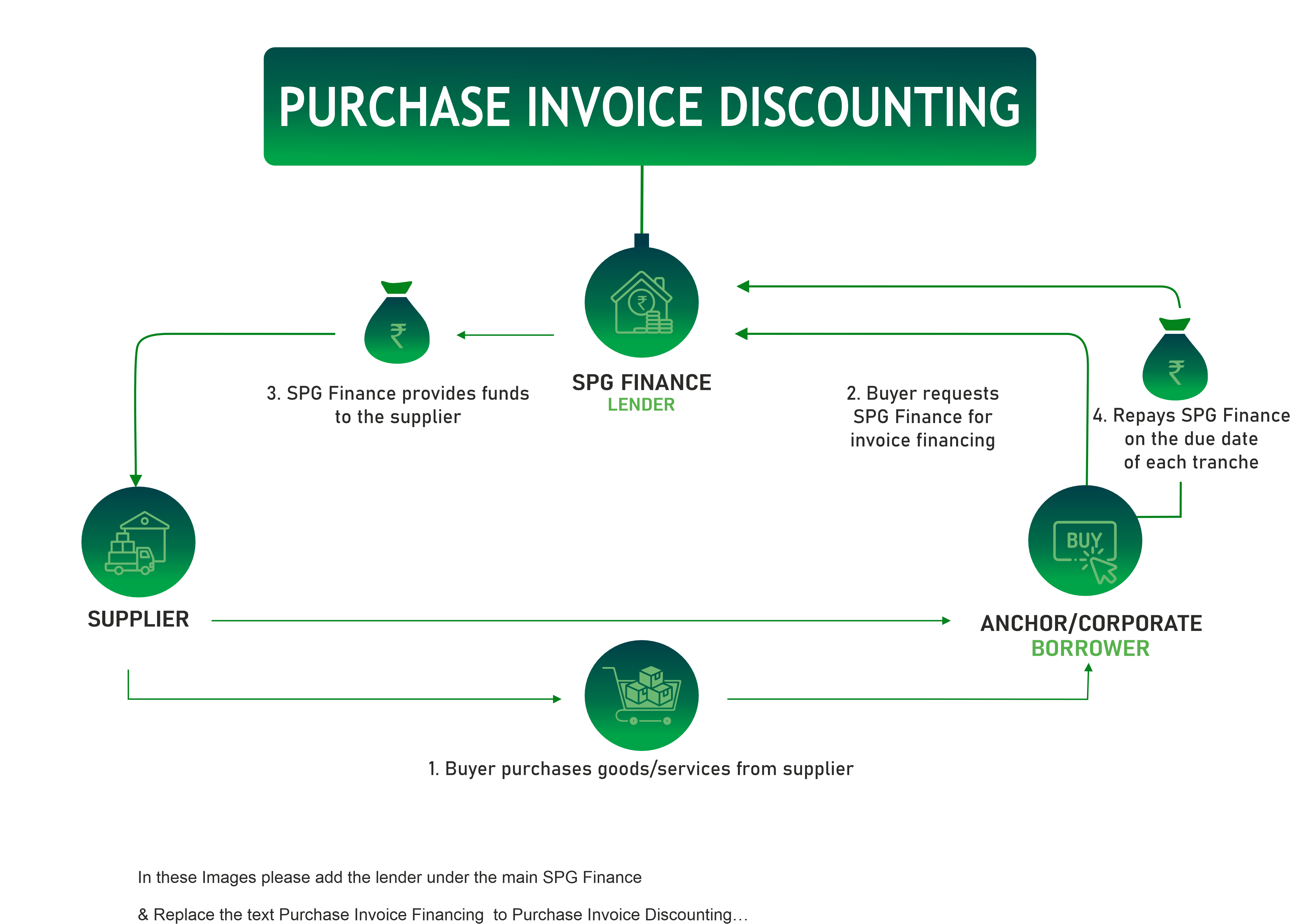

Purchase Invoice Discounting:

Under Purchase Invoice Discounting arrangement, SPG Finance discounts Purchase Invoices of Anchor/Corporate for the purchases they make from multiple vendors/suppliers. SPG Finance makes payments directly to the approved suppliers recommended by the Anchor. In this arrangement, the Anchor/Corporate is the borrower.

How does it work?

- Anchor/Corporate purchases goods or services from a supplier.

- The Anchor/Corporate raises disbursement request to SPG Finance for making payment to the supplier on behalf of the Anchor/Corporate.

- SPG Finance then makes payments directly to the approved suppliers, upon receiving a disbursement request from the Anchor/Corporate along with the supporting invoices.

- On the due date, the Anchor/Corporate repays SPG Finance the lender the outstanding loan amount.

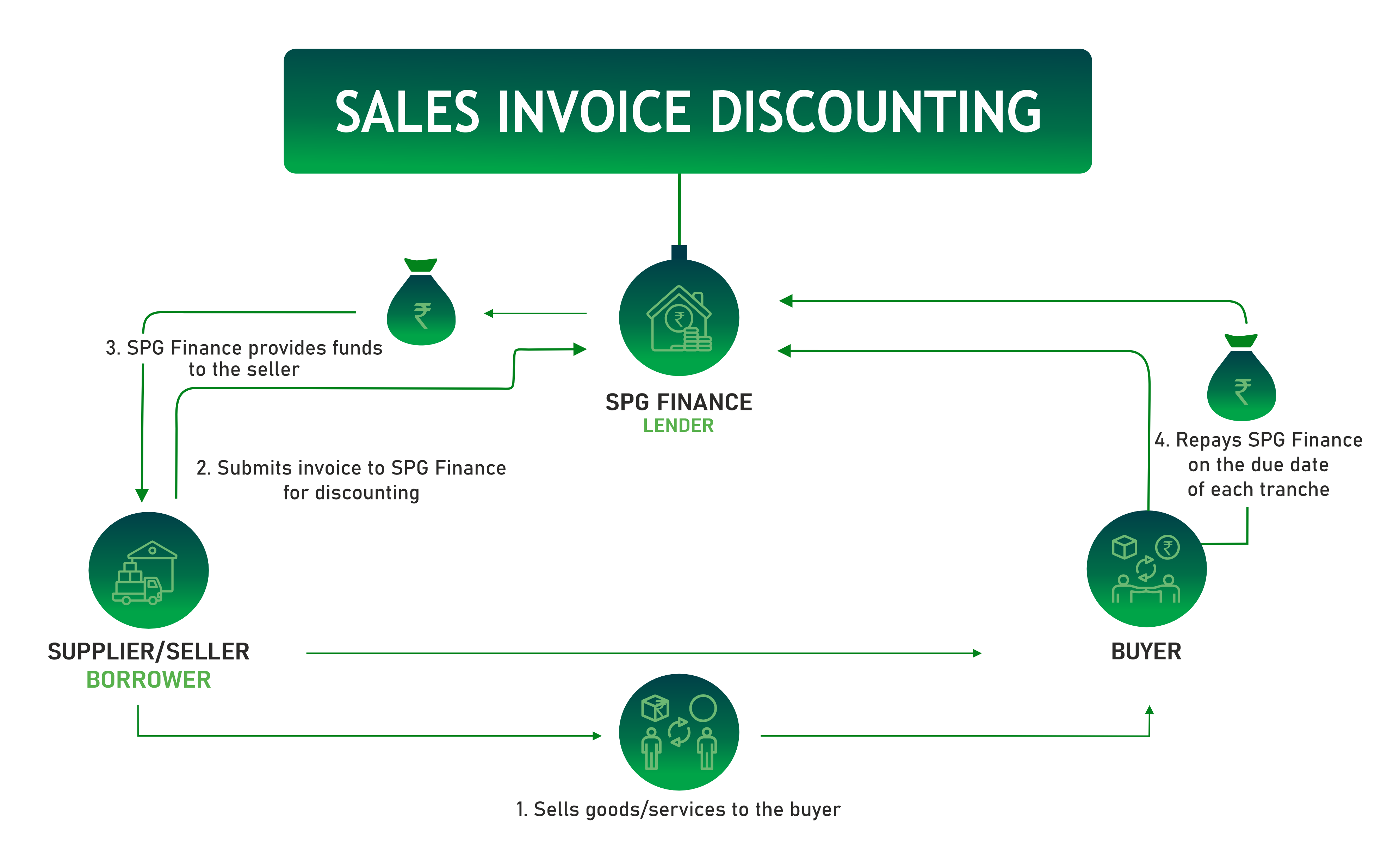

Sales Invoice Discounting:

Sales Invoice Discounting is an arrangement where an Anchor/Corporate gets their sales invoices discounted from SPG Finance before the due dates for the invoices improving liquidity and ensuring smooth cashflow.

How does it work?

- An Anchor/Corporate sells goods or services to a reputed customer/buyer with deferred payment terms.

- The Anchor/Corporates submits the sales invoice to SPG Finance for discounting under the Sales Invoice Discounting facility.

- SPG Finance makes upfront payment to the Anchor/Corporate against the sales invoice.

- On the due date, the customer/buyer repays SPG Finance either directly or through an escrow account.

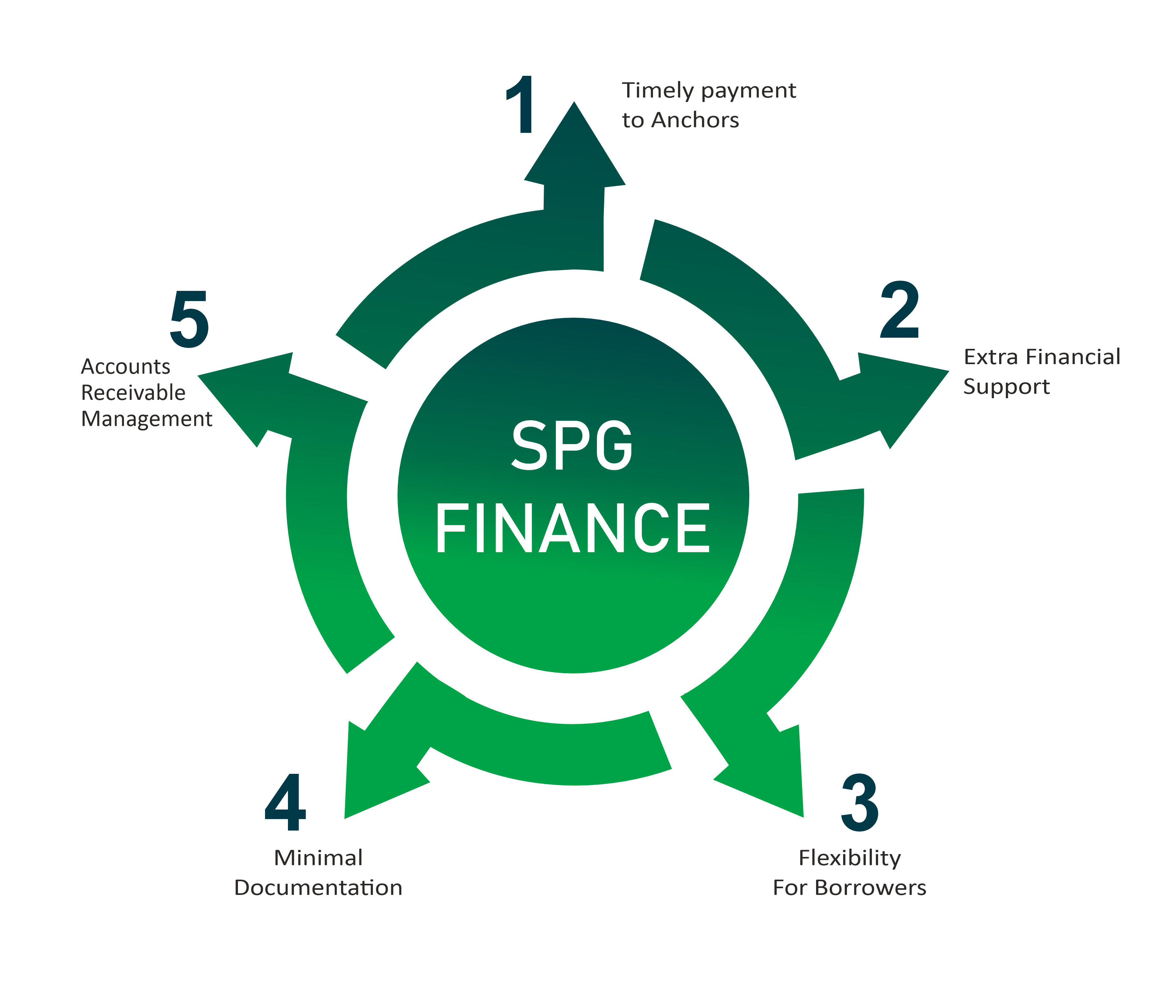

Partnership Benefits

Anchor Benefits

- The Anchor/Corporates benefits from the financing solution provided by SPG Finance, ensuring timely payments from Dealers, which enhances cash flow and reduces payment delays.

- Anchors/Corporates gain improved monitoring and greater control over dealer relationships.

- The Anchor/Corporates may benefit from flexible, short-term financing options, which can be adjusted based on changing business needs or seasonal demands.

- An Anchor/Corporates benefits by providing financing support to its suppliers and buyers without increasing debt on its own balance sheet.

- It helps the Anchor/Corporates manage its accounts receivable more effectively.

Borrower Benefits

- Supply Chain Finance helps borrower to manage the working capital gap in an efficient manner.

- The borrower can access immediate funds through SPG Finance, ensuring timely payments to Anchors/Corporates and strengthening relationships, often resulting in better credit terms.

- Broadly unsecured structure that provides access to additional finance with minimal documentation.